Davidson Nc Property Tax Rate . davidson county, north carolina. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. Town of davidson current budget information including. property taxes are assessed at a rate which is applied to every $100 of property value. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. the town of davidson's fiscal year runs from july 1 to june 30. All property was revalued in mecklenburg and. for comparison, the median home value in davidson county is $128,200.00. the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). If you need to find your property's most recent tax.

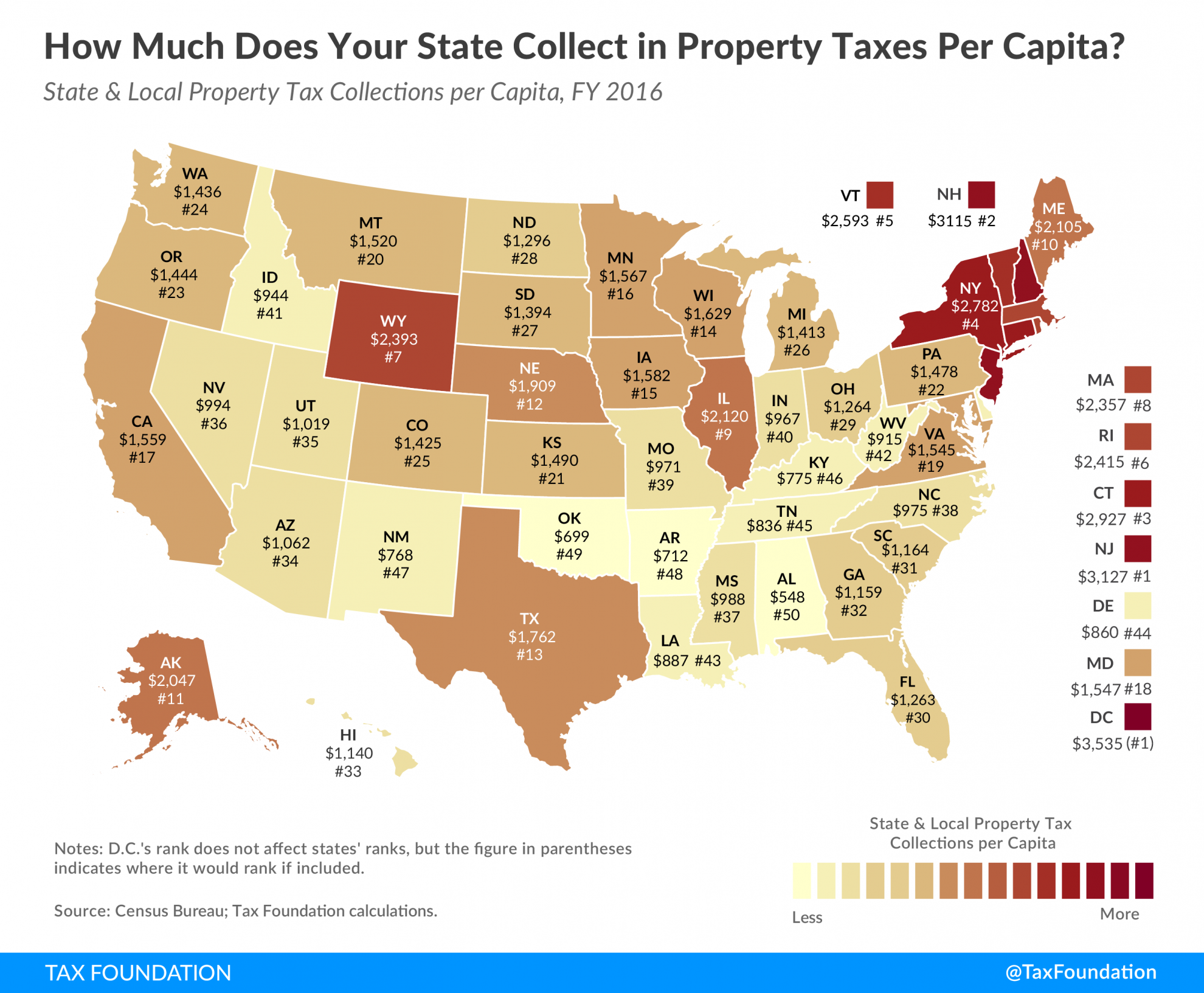

from taxfoundation.org

The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. If you need to find your property's most recent tax. Town of davidson current budget information including. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). All property was revalued in mecklenburg and. property taxes are assessed at a rate which is applied to every $100 of property value. the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. for comparison, the median home value in davidson county is $128,200.00.

Property Taxes Per Capita State and Local Property Tax Collections

Davidson Nc Property Tax Rate for comparison, the median home value in davidson county is $128,200.00. davidson county, north carolina. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. the town of davidson's fiscal year runs from july 1 to june 30. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. Town of davidson current budget information including. property taxes are assessed at a rate which is applied to every $100 of property value. If you need to find your property's most recent tax. All property was revalued in mecklenburg and. for comparison, the median home value in davidson county is $128,200.00.

From www.thecentersquare.com

Property tax rate is 19th lowest in country North Carolina Davidson Nc Property Tax Rate for comparison, the median home value in davidson county is $128,200.00. davidson county, north carolina. the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. the town of davidson's fiscal year runs from july 1 to june 30. Town of davidson current budget information including. property tax rates and reappraisal. Davidson Nc Property Tax Rate.

From learningmacrorejs.z14.web.core.windows.net

Nc County Tax Rates 2024 Davidson Nc Property Tax Rate the town of davidson's fiscal year runs from july 1 to june 30. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. davidson county, north carolina. All property was revalued in mecklenburg and. property taxes are assessed at a rate which is applied to every. Davidson Nc Property Tax Rate.

From collins.legal

Two Reasons Your Davidson County Property Taxes Increased in 2021 Davidson Nc Property Tax Rate If you need to find your property's most recent tax. property taxes are assessed at a rate which is applied to every $100 of property value. All property was revalued in mecklenburg and. Town of davidson current budget information including. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. for comparison, the median home value in davidson county is $128,200.00.. Davidson Nc Property Tax Rate.

From www.ncjustice.org

N.C. Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Davidson Nc Property Tax Rate property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. the town of davidson's fiscal year runs from july 1 to june 30. To provide a quick and easy listing experience, davidson county now provides an. Davidson Nc Property Tax Rate.

From printableranchergirllj.z22.web.core.windows.net

Orange County Nc Tax Rate Davidson Nc Property Tax Rate the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. the town of davidson's fiscal year runs from july 1 to june 30. davidson county, north carolina. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. property tax rates and reappraisal schedules for. Davidson Nc Property Tax Rate.

From iseriescaplioquora.pages.dev

Understanding North Carolina Property Taxes North Carolina Home Property Tax Rates Davidson Nc Property Tax Rate All property was revalued in mecklenburg and. property taxes are assessed at a rate which is applied to every $100 of property value. If you need to find your property's most recent tax. Town of davidson current budget information including. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses. Davidson Nc Property Tax Rate.

From iseriescaplioquora.pages.dev

Understanding North Carolina Property Taxes North Carolina Home Property Tax Rates Davidson Nc Property Tax Rate davidson county, north carolina. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). If you need to find your property's most recent tax. property taxes are assessed at a rate which is applied to every $100 of property value. the town of davidson contracts with mecklenburg county and iredell county. Davidson Nc Property Tax Rate.

From passedvenicesupplier.pages.dev

Understanding North Carolina Property Taxes North Carolina Home Property Tax Rates Davidson Nc Property Tax Rate the town of davidson's fiscal year runs from july 1 to june 30. All property was revalued in mecklenburg and. for comparison, the median home value in davidson county is $128,200.00. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. the town of davidson contracts. Davidson Nc Property Tax Rate.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Davidson Nc Property Tax Rate davidson county, north carolina. the town of davidson's fiscal year runs from july 1 to june 30. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. for comparison, the median home value in davidson county is $128,200.00. property taxes are assessed at a rate. Davidson Nc Property Tax Rate.

From exolewmbw.blob.core.windows.net

Davidson County Nc Real Estate Tax Rate at Jospeh Hackett blog Davidson Nc Property Tax Rate the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). If you need to find your property's most recent tax. Town of davidson current budget information including. the town of. Davidson Nc Property Tax Rate.

From www.taxuni.com

North Carolina Property Tax Davidson Nc Property Tax Rate property taxes are assessed at a rate which is applied to every $100 of property value. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. davidson county, north carolina. the town of davidson's fiscal year runs from july 1 to june 30.. Davidson Nc Property Tax Rate.

From ryan-llc.foleon.com

July 2019 Issue North Carolina PT Rates Davidson Nc Property Tax Rate the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. Town of davidson current budget information including. All property was revalued in mecklenburg and. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). If you need to find your property's most recent tax. The median property tax. Davidson Nc Property Tax Rate.

From www.ezhomesearch.com

The Ultimate Guide to North Carolina Property Taxes Davidson Nc Property Tax Rate The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). Town of davidson current budget information including. for comparison, the median home value in davidson county is $128,200.00. the town of davidson contracts with mecklenburg. Davidson Nc Property Tax Rate.

From learningmacrorejs.z14.web.core.windows.net

North Carolina State Tax Rates 2024 Davidson Nc Property Tax Rate If you need to find your property's most recent tax. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. All property was revalued in mecklenburg and. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses. Davidson Nc Property Tax Rate.

From brevardnewsbeat.substack.com

Would "Regressive" Sales Tax Create Less New Burden on County Taxpayers? Davidson Nc Property Tax Rate the town of davidson's fiscal year runs from july 1 to june 30. To provide a quick and easy listing experience, davidson county now provides an online listing option for our businesses and individual. Town of davidson current budget information including. The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. . Davidson Nc Property Tax Rate.

From 6thmanmovers.com

Davidson County Property Tax & Nashville Property Tax [2024] 💰 Nashville Property Tax Rate Davidson Nc Property Tax Rate the town of davidson's fiscal year runs from july 1 to june 30. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). If you need to find your property's most recent tax. the town of davidson contracts with mecklenburg county and iredell county to collect property taxes. To provide a quick. Davidson Nc Property Tax Rate.

From www.integrityallstars.com

2022’s Property Taxes by State Integrity All Stars Davidson Nc Property Tax Rate The median property tax (also known as real estate tax) in davidson county is $855.00 per year,. davidson county, north carolina. If you need to find your property's most recent tax. davidson.5400.5400.5400.5400.5400 2021 2027 davie.7330.7330.7330.7380.7380 2021 2025. for comparison, the median home value in davidson county is $128,200.00. Town of davidson current budget information including. property. Davidson Nc Property Tax Rate.

From exolewmbw.blob.core.windows.net

Davidson County Nc Real Estate Tax Rate at Jospeh Hackett blog Davidson Nc Property Tax Rate for comparison, the median home value in davidson county is $128,200.00. All property was revalued in mecklenburg and. property tax rates and reappraisal schedules for north carolina counties (all rates per $100 valuation*). davidson county, north carolina. If you need to find your property's most recent tax. property taxes are assessed at a rate which is. Davidson Nc Property Tax Rate.